2024 Home Energy Tax Credits – Installing solar panels on your home likely qualifies you for the residential clean energy credit from the federal government. This covers up to 30% of the cost of solar panel installations done . If you make qualified energy-efficient improvements to your home after Jan. 1, 2023, you may qualify for a tax credit up to $3,200. The home improvement tax credits you can get in 2024 You can get .

2024 Home Energy Tax Credits

Source : www.landmarkcpas.com2024 Home Energy Federal Tax Credits & Rebates Explained

Source : www.nicksairconditioning.comSolar Tax Credit By State 2024 – Forbes Home

Source : www.forbes.comSave more in 2024 with larger incentives from Energy Trust

Source : blog.energytrust.orgThese Green Energy Tax Breaks Could Give You a Bigger Tax Refund

Source : www.cnet.comMissouri Solar Incentives, Tax Credits And Rebates Of 2024

Source : www.forbes.comHow to Claim the Solar Tax Credit in 2024 | Arizona

Source : southfacesolar.comClaim Inflation Reduction Act Credits on Your Tax Return

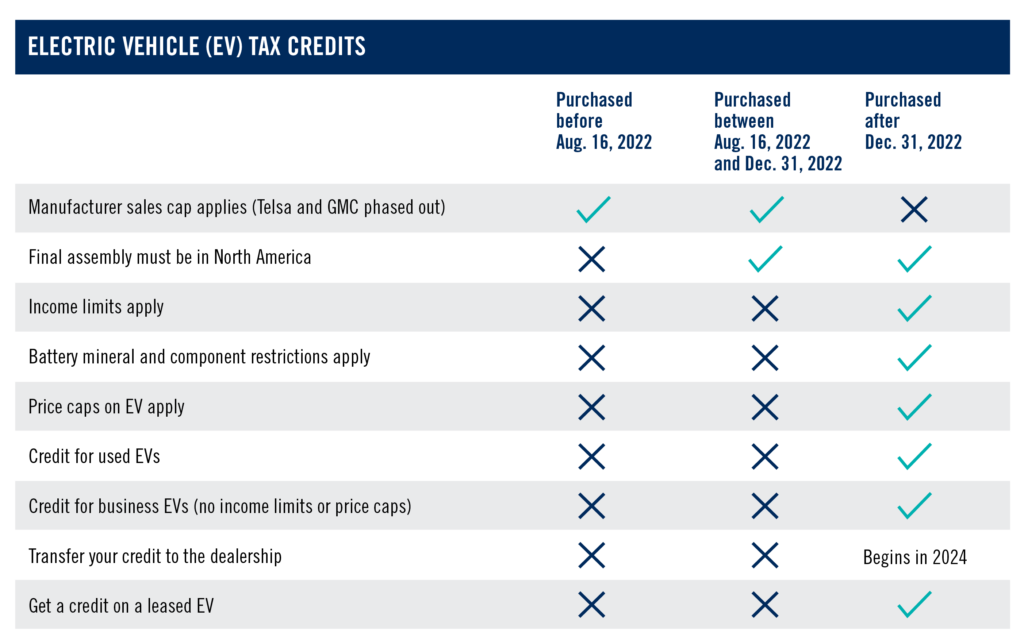

Source : www.cainwatters.comHow to Claim the Solar Tax Credit in 2024 | Arizona

Source : southfacesolar.comIdaho Solar Incentives, Tax Credits And Rebates Of 2024 – Forbes Home

Source : www.forbes.com2024 Home Energy Tax Credits What to Know About Home Energy Tax Credits in 2024 Landmark CPAs: If you gave your home an eco-friendly makeover in 2023, don’t forget to look into the IRS’ new and improved energy tax credit for additional savings. Many or all of the products featured here . Key Takeaways The federal solar Investment Tax Credit (ITC) offers a direct reduction in taxes owed as an incentive for installing a new solar energy system. Per the Inflation Reduction Act .

]]>